This is a follow up post to the previous post (Cisco Systems Inc. (NASDAQ: CSCO) Undervalued). Before continuing to read this post, I suggest reading the previous post if you haven’t already. The previous post includes some important facts that are not included in this post. If you have any questions/comments, feel free to leave a comment below or contact me. Thank you.

On Wednesday (August 12, 2015), Cisco (NASDAQ: CSCO) reported its first earnings report with Chuck Robbins (CEO of Cisco) at the helm and it was very impressive. For 4th Quarter Fiscal Year 2015 (Q4 FY’15), revenue was $12.8 billion, up 3.9% year-over-year (Y/Y) from $12.4 billion and EPS (GAAP) was $0.45 per share, up 4.7% Y/Y from $0.43. Net income (GAAP) was $2.3 billion, up 3.2% Y/Y from $2.2 billion.

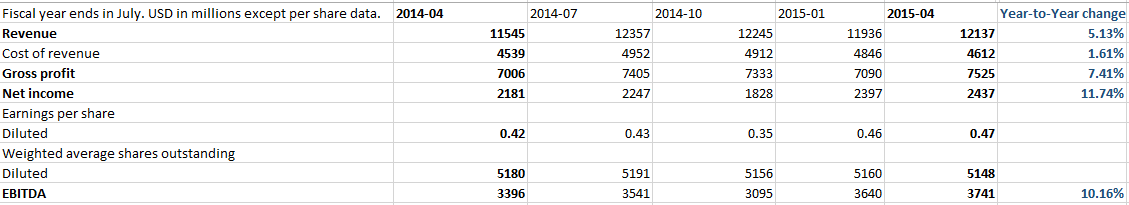

This earnings report concludes Fiscal Year (FY) 2015. Let’s take a look at FY GAAP results. FY’15 revenue grew 4.3% year-over-year to $49.2 billion from $47.1 billion. Net income grew 14.4% to $9 billion from $7.9 billion and EPS grew 17.4% to $1.75 from $1.49.

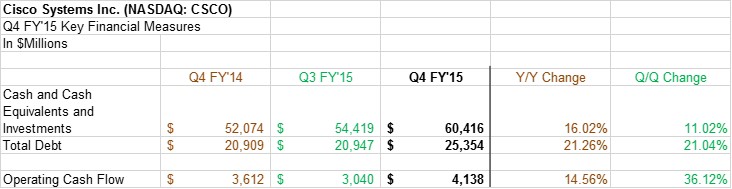

During FY’15, Cisco continued its commitment to shareholder return – returning $8.3 billion through share buybacks and dividends – 73% of free cash flow. Yet, Cisco has total cash, cash equivalents, and investments of $60.4 billion, up 16.02% Y/Y from $52 billion in Q4 FY’14.

The company has $25.4 billion in debt, 21.26% increase Y/Y. Their operating cash flow increased 14.56% Y/Y to $4.1 billion. I don’t see the current debt as a problem since the company has a strong balance sheet.

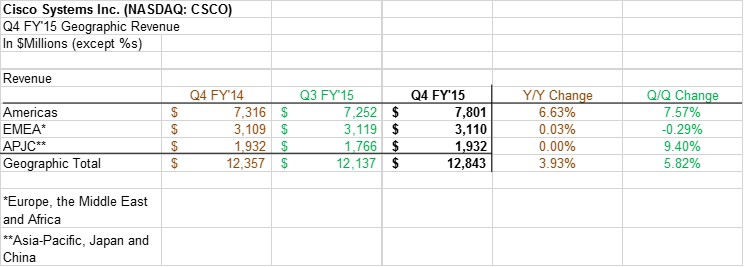

Regional Performance:

Americas revenue increased 6.63% Y/Y to $7.8 billion. EMEA (Europe, the Middle East and Africa) was slightly flat at $3.1 billion. APJC (Asia-Pacific, Japan and China) was flat at $1.9 -billion. Both EMEA and APJC revenue was affected by forex (currency) headwinds. With strengthening dollar – which hurts sales revenue aboard – Cisco should be able to offset the headwinds from it because of a strong domestic market. Stronger dollar makes American goods expensive and less competitive overseas, hurting earnings for U.S. companies. Cisco has a very strong domestic market and continues to increase its footsteps.

Guidance: (Not a big fan of guidance)

Cisco expects 2%-4% Y/Y revenue growth and EPS of $0.55-$0.57 for Q1 FY’16, in-line with a consensus for 2.5% growth and EPS of $0.56. While company’s guidance is important, I believe your own guidance for the company is more important.

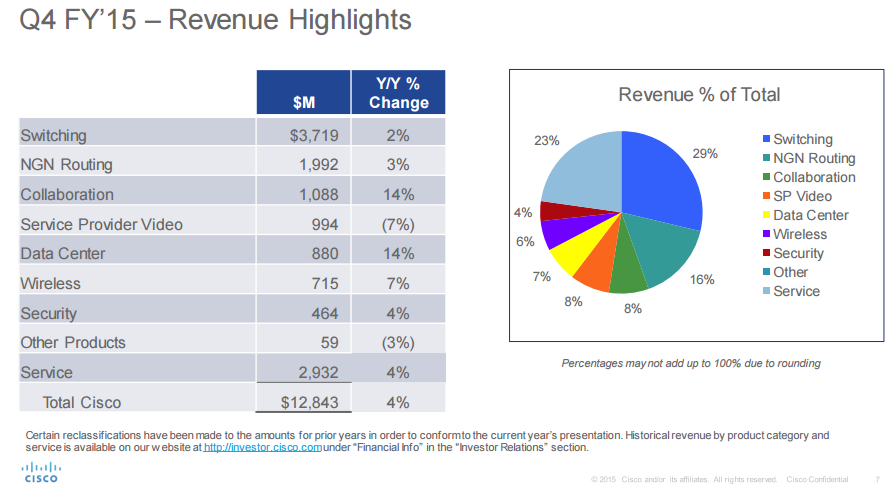

Segment Performance:

Product revenue grew 4% Y/Y. Out of nine segments, two segments (“Service Provider Video” and “Other Products”) declined Y/Y, but remaining seven segments grew.

Today, Cisco is looking to acquire businesses focusing on wireless software, video delivery, cloud-based security technologies and investments in cyber-security. They are more likely to acquire smaller companies with strong presence in areas (product and geography) that Cisco itself does not have. The company plans to invest $1 billion into the United Kingdom over the next 3-5 years to boost the country’s technology sector, especially Internet of Things (IoT). During the Q4 FY’15 Conference call, Kelly Kramer, Chief Financial Officer (CFO) stated that Cisco was “…committed to looking at the right acquisitions at the right price to drive our growth strategy.” I’m currently looking into companies that I believe Cisco should acquire (post to come regarding it, if I find a suitable company).

Key Financials:

In the “Key Financials” chart above, you see “EBITDA” and “EBIT”. Let me take a moment to explain what they are and why they are important.

EBITDA: An acronym for “Earnings Before Interest, Taxes, and DD&A (Depreciation, Depletion and Amortization)”. It’s an income statement metric which represents earnings prior to the payment of interest expense, taxes, depreciation, depletion and amortization. EBITDA is a proxy for (but not a substitute for) cash flow generated by the assets of a company (In this case, Cisco) before debt holders and tax authorities are paid. A good EBITDA growth rate can show investors that the company has a future for potential growth.

EBIT: An acronym for “Earnings Before Interest and Taxes”. EBIT is similar to EBITDA, but It’s an income statement metric which represents earnings prior to the payment of interest expense and taxes.

5-Year CAGR (Compounded Annual Growth Rate):

- Total Revenue: 4.19%

- Gross Profit: 2.86%

- EBITDA: 4.14%

- EBIT: 3.57%

- Net Income: 2.95%

While 5-Year CAGR numbers may look small, it’s very reasonable for a company of Cisco’s size.

I love the valuation at current levels. My target price is $32, unchanged from previous post. I’m taking “Warren Buffett” style approach on Cisco. I’m in this for a longer-term and my target price will change as time goes on. Strategic acquisitions, for example, will increase my target price because in the longer-term, the acquired company (depending on the company) will bring in more income although there will be costs in a short-term. After all, it’s the opportunity cost.

Any pullbacks in the stock price will be taken as an opportunity to buy more shares. The only con are the brokerage fees that comes as a disadvantage to small investors like myself.

If you have been wondering why non-GAAP numbers are not listed here, it’s because I don’t look at them much. Companies can do whatever they want to do with it and it’s hard to trust the non-GAAP numbers. On Cisco’s financial reports, they state “These non-GAAP measures are not in accordance with, or an alternative for, measures prepared in accordance with generally accepted accounting principles and may be different from non-GAAP measures used by other companies.”

Non-GAAP is a propaganda tool to raise capital and/or stock price (AKA equity compensation).

I’m not saying I don’t look at non-GAAP numbers, but GAAP is much more important to look at. Exceptions to look at non-GAAP are when there are such reasonable large write-downs and/or restructuring charges (one-time, non-recurring” expenses). Reasonable.

All comments welcomed.

Disclosure: I’m currently long on the stock, CSCO. I went long last year at price just below $25. I will continue to be long.

Note: All information I used here such as revenue, income, etc are found from Cisco’s official investor relations site, Bloomberg terminal, FactSet, and S&P Capital IQ. The pictures you see here are my own (except “Cisco Segment Performance – Q4 F’15”).

Disclaimer: The posts are not a recommendation to buy or sell any stocks, currencies, etc mentioned. They are solely my personal opinions. Every investor/trader must do his/her own due diligence before making any investment/trading decision.