Ahh! GoPro (NASDAQ: GPRO). A stock that gravity took over. It crushed from $98.47 (early October 2014) all the way down to $15.90 (mid December 2015). Boy, was Citron Research right, when they predicted share-price would drop to $30 within a year, in November of the last year.

And what now? Is this end of GoPro or is there more?

As for me, I’m very skeptical of the market. I’m someone who loves to go against the investments of the crowd.

For example, when the Alibaba (NYSE: BABA) was launched, I was convinced that the market was hyped about it and I didn’t find any intrinsic value in BABA’s share price. Recent market sentiment about GoPro is SELL SELL SELL!!! Me being the skeptic, I say BUY BUY BUY!!!

And it’s not just because of my skepticism of the market, but because of Karma and more.

Karma is coming in 2016 for the short-sellers of GPRO. So take your profit while you can. GoPro has planned to launch its first drone, Karma in 2016. The introduction of a drone will expand camera maker’s product line, beyond making action cameras.

The release of Karma is released, will launch GoPro into Unmanned Aircraft Vehicle (UAV) market. The Smart Commercial Drones Market is expected to reach $27.1 billion by 2021 from $3.4 billion in 2014, according to Wintergreen Research, Inc’s report, “Smart Commercial Drones: Market Shares, Market Strategies, and Market Forecasts, 2015 to 2021.” According to the report, “The commercial grade consumer video drone segment is the largest one in terms of revenue in 2015, and it is expected to lead over the forecast period.”

GoPro founder and CEO Nick Woodman said at the TechCrunch conference in September that the company is planning to launch a drone in the first half of 2016, “development is on track for the first half of 2016. We have some differentiations that are right in the GoPro alley.” Karma is finally coming.

Hollywood is eager to change the way they take aerial shots. Not long ago, they used helicopters (some still do) to shoot from bird’s point-of-view and it costs a lot. Drone makes it all cheaper. Not only cheaper, but also safer and opens more creative ways of shooting a video. In other words, drones can do what helicopters cannot do.

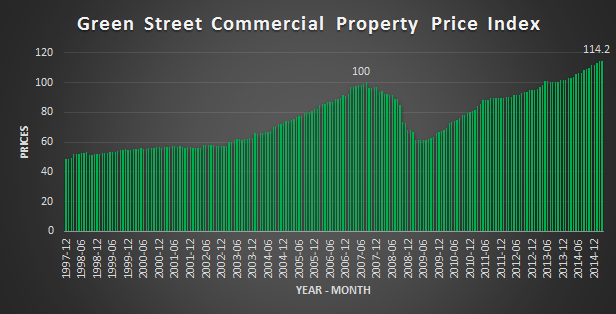

On May 28, GoPro announced at Google’s I/O conference that it will build a 360-degree camera array for stereoscopic spherical videos. With the help of Google Jump, Google’s virtual reality system, GoPro’s camera array, Odyssey can make videos like this. I believe the Odyssey can be very useful for real estate market. “360-Degree Real Estate Tour – Brought to you by GoPro.”

Oh, did I mention Odyssey has 16 cameras that work together as one? I repeat, 16. Hey GoPro, why don’t you knock out your useless and wasteful $300 million buyback program out of the park? According to its third-quarter SEC filing (10-Q), GoPro stated,

“To the extent that current and anticipated future sources of liquidity are insufficient to fund our future business activities and requirements, we may be required to seek additional equity or debt financing. In the event additional financing is required from outside sources, we may not be able to raise it on terms acceptable to us or at all.”

They spend 345x more on buybacks than they do on research and development. So GoPro, eliminate your worthless buyback program. “Customize” the money into research and development, and acquisitions. Customize the Odyssey. 16 cameras? Really? Reduce the size and improve the quality.

I strongly believe GoPro should acquire a small thermal imaging company. Thermal imaging can be a perfect fit for drones. I suggest GoPro acquires Seek Thermal, designer and manufacturer of high quality thermal imaging products. If GoPro acquires Seek Thermal or a different thermal imaging tech company, they will be able to reach sectors such as firefighting and agriculture. Diversified!

Partnership with Rollei – a German manufacturer of optical instruments and a seller of GoPro compatible accessories – might be helpful.

Another great acquisition can be Vuzix (NASDAQ: VUZI), a Google Glass rival, and a leading developer and supplier of smart glasses and video eyewear products in the consumer enterprise and industrial markets. Vuzix holds over 41 patents and 10 additional patents pending. Market cap. is currently $104.39 million. With $513 million cash on hand, GoPro can afford the acquisition. In January, Vuzix received a $24.8 million investment from Intel (NASDAQ: INTC). Intel bought preferred stock that is convertible into common shares equivalent to 30% of Vuzix.

In the third-quarter, GoPro’s revenue increased 43% year-over-year (Y/Y) to $400.3 million. On non-GAAP basis, its net income, operating income, and operating expenses increased 103.9% Y/Y, 71.7% Y/Y, and 44.3% Y/Y, respectively. On GAAP basis, it increased 28.58%, 105.36%, and 43.78%, respectively. The growth isn’t bad for a company with a market cap. of $2.49 billion. However, its inventory days increased 80.6% Y/Y from 67.7 to 122.3.

There are buyout rumors and one of the potential suitors being Apple (NASDAQ: AAPL). While this is a great news, it is not likely to happen in the first half of 2016. I believe the management of GoPro would not want to sell the company until they see the outcome of Karma. If the outcome is positive, the company will not be sold next year. If it is negative, the company will be sold unless they have something up in their sleeves. Management’s actions should a sign of what’s to come.

I’m confident the founder of GoPro will turn things around next year. GoPro can be a leader in its field if it eliminates the buyback program and invests into the future. According to Futuresource Consulting, the global action camera market grew by 44% Y/Y in 2014. It is expected to grow at a compound annual growth rate (CAGR) of 22.2% between 2014 and 2019. GoPro should target not only sport enthusiasts, but the film and television industry, real estate, and other sectors such as, firefighting and agriculture. In order to do that, GoPro should first create a product that suits the sector’s needs. First impressions are important.

Disclosure: I’m currently long on the stock, GPRO, at this time (December 26, 2015).

Note: All information I used here such as revenue, net income, etc are found from GoPro’s official investor relations site and its SEC filings.

Disclaimer: The posts are not a recommendation to buy or sell any stocks, currencies, etc mentioned. They are solely my personal opinions. Every investor/trader must do his/her own due diligence before making any investment/trading decision.