On Wednesday (January 21, 2015), Bank of Canada (BOC) announced that it is cutting the overnight rate to 0.75% from 1.00%. Bank rate and deposit rates stay the same, bank rate at 1.00% and deposit rate at 0.5%. Their reason for cutting overnight rate by a quarter?

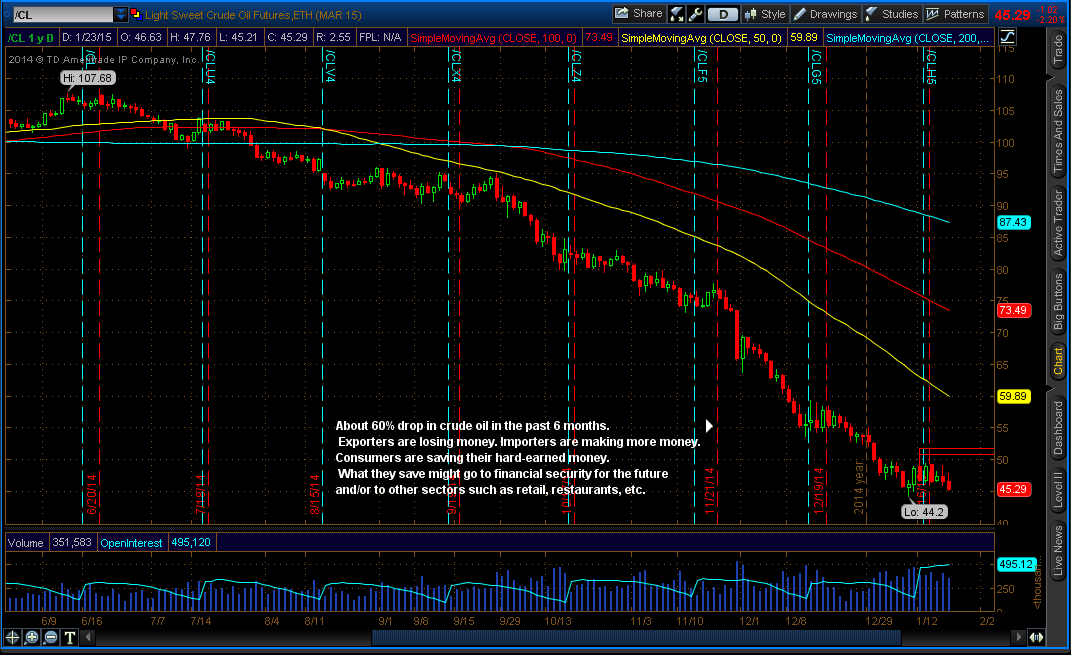

Oil is the reason. For the past six months, crude oil (WTI) has been declining about 60%. BOC says that drop in oil prices are “negative for growth and underlying inflation…”. Fall in oil prices hurts Canadian economy because they are 3rd largest oil-exporting country. Oil-importing countries, such as China and the United States are benefiting from low oil prices.

Immediately after the announcement, loonie (CAD) fell over 200 pips, pushing USD/CAD to 1.2273 from 1.2063 (210 pips) in first 15 minutes (From 10:00 AM to 10:15 AM). USD/CAD kept hitting new highs since early 2009 (still is, for now). BOC expects oil prices to be around $60 in medium term (next two years). During the opening statement, BOC governor, Stephen S. Poloz said something that gave little more power for loonie to decline.

During the opening statement, Governer Poloz said “The Bank has room to maneuver should its forecast prove to be either too pessimistic or too optimistic.” If conditions gets worse than what BOC expects, they might cut the overnight rate further. The statement caused USD/CAD to jump little higher. At the end, one thing that was said surprised me. Governor said “…we discussed the risk that by moving today we would surprise financial markets. We generally prefer that markets not be surprised by what we do…” Two opposite things are being said here. But, there were some rumors to rate cut days before. Since oil price decline increases the downside to Canadian economy. Rate cuts are” intended to provide insurance against these risks.”

If oil continues to decline until March, BOC might cut the overnight rate. I believe that because they warned us of further cuts from both on a press release and press conference. As of right now, I believe crude oil will fall to an area of $40.50. Then, stay there for several weeks. I’m saying this because technical analysis. I’m not an expert on crude oil, yet.

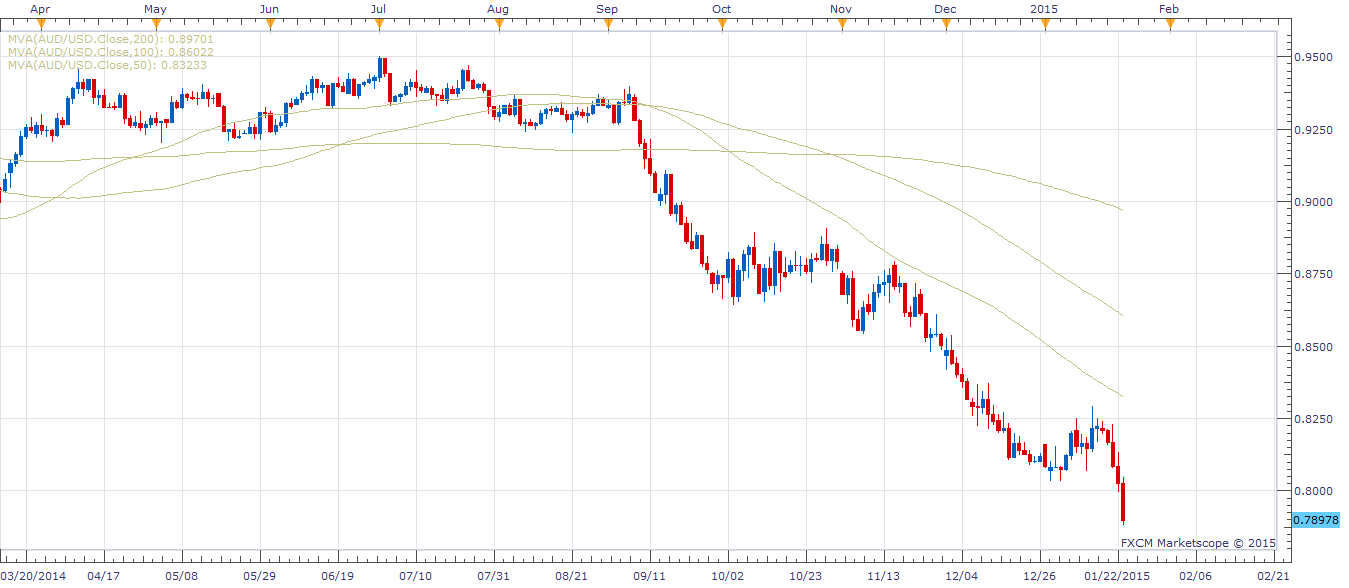

Who’s next to cut the rates? I believe it’s Reserve Bank of Australia (RBA). Since August 2013, Cash Rate Target has been staying at 2.50%. In the beginning, most of their monetary policy decisions statements included sentences “The exchange rate remains high by historical standards, particularly given the declines in key commodity prices, and hence is offering less assistance than it might in achieving balanced growth in the economy.” Now, they say “The exchange rate has traded at lower levels recently, in large part reflecting the strengthening US dollar. But the Australian dollar remains above most estimates of its fundamental value, particularly given the significant declines in key commodity prices in recent months. A lower exchange rate is likely to be needed to achieve balanced growth in the economy”. They were saying that to weaken Aussie. They know how much their “words” has the power to cause large changes in the exchange rate. In the long-term, AUD/USD was (still is) in a downtrend. They might cut rates in February (February 2, 2015) or March (March 2, 2015), to further weaken Aussie. Further information about RBA monetary policy can be found here. (Note: times/dates are in EST).